The Year of Surprises

2016 was a year in which political surprises dominated global headlines. From Brexit to Donald Trump, populism gained momentum around the world shocking insiders, giving hope to outsiders, and leaving market pundits to figure out what this all means for the future....

The Long and Short of It

As John Maynard Keynes so eloquently put in his book “The General Theory of Employment, Interest and Money” nearly 80 years ago, investing is about the long term. If we just thought of investing like so many other long term focuses in our lives, we would all no doubt...

Toro Bravo – “Fighting Bull”

Overall, market fundamentals are in good but not great shape. Worldwide economies are slowing and uncertainty continues to dominate headlines, but it's not a reason to head for the hills. In addition, with a backdrop of continued low interest rates (either next to...

“Brexit” – What does it mean?

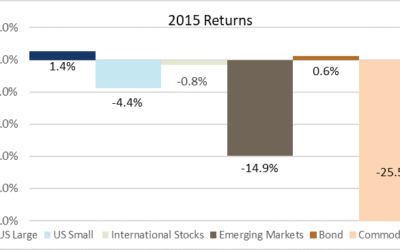

Here's what happened: Yesterday, UK voters elected to leave the European Union (EU) – the “Brexit”. As a result, market volatility has increased sharply. While the “Brexit” referendum won last night, the process of leaving will be long and arduous. Many are...

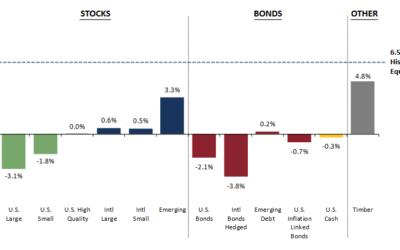

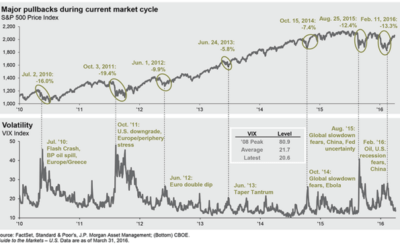

A “V” Market

“V” is for the volatility that the market experienced in the first quarter. It’s also the shape which the S&P formed over that same time period. The first half of the quarter consisted of wild daily swings and a sharp decline (down 11%), while wild daily swings...

Cautiously Optimistic

As we enter 2016, we remain mindful that we are in the 7th year of a strong bull market, and as the length of its run grows longer, emotions rather than sound advice and fundamentals tend to drive prices. Volatile price swings in both directions become commonplace and...

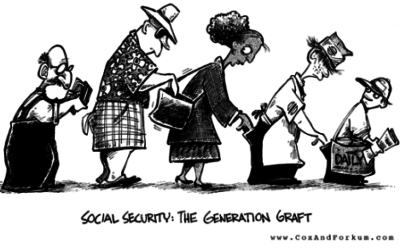

Policy Update – Social Security Benefits

Recently Congress announced that it is making changes to the Social Security filing strategies that many couples have used for years to add thousands of dollars to their retirement incomes. Before you read any further, please note that if you are already receiving...

Opportunity in a Changing Market (Roth IRAs)

Convert, De-convert, Re-convert…The stock market's recent drop has no immediate tax impact on traditional or Roth IRAs invested in stocks and ETFs. That's because neither losses nor gains are recognized within IRAs. However, in today’s market, if there is a silver...

Continued Mutual Fund Underperformance

Most of our clients know we are big believers in low cost investing with passive investment vehicles. Although it is easy to grasp the concept of paying lower costs, it is harder to grasp that you can pay lower costs and also outperform most other investments. The...

IRS “Throws in the Towel” on 401(k) Roth Conversions

For years the IRS held strong: When rolling over 401(k) funds, after-tax and pre-tax funds are distributed pro-rata. However, with the recent issuance of IRS Notice 2014-54, the rules have changed. Historically, for those who maxed out their tax-deferred growth...