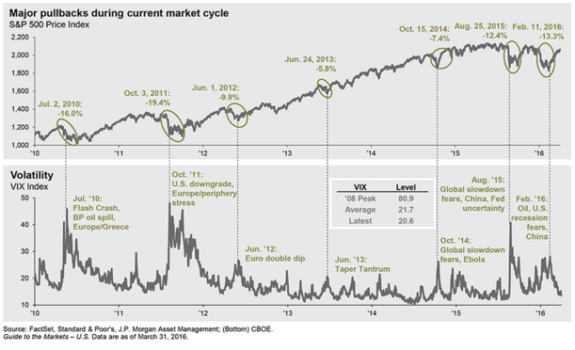

“V” is for the volatility that the market experienced in the first quarter. It’s also the shape which the S&P formed over that same time period. The first half of the quarter consisted of wild daily swings and a sharp decline (down 11%), while wild daily swings and a subsequent sharp increase (up 13%) made up the second half. Despite all of the crazy movements, the S&P 500 ended right about where it started, +1.30%.

It was a crazy first quarter and an extremely tough one for investment managers. Nearly 80% of Large Cap mutual funds underperformed the S&P 500, and unfortunately, it doesn’t seem like the backdrop for the second quarter will get any easier. Despite the volatility, and the sharp reversal to the upside, the same fears and issues remain: oil price volatility, global slowdown fears, Fed uncertainty, China destabilization, and presidential election uncertainty. Because things have yet to paint a clearer picture, our strategy largely remains unchanged.