Qualified Opportunity Zones in Virginia

Tax-Deferral Opportunity on the Sale of Low-Basis Assets: Are you considering selling stock, real estate, or a business that has substantially appreciated in value? Are you concerned with the capital gains tax that will accompany those sales? The December 2017 Tax...

Where Do We Go From Here?

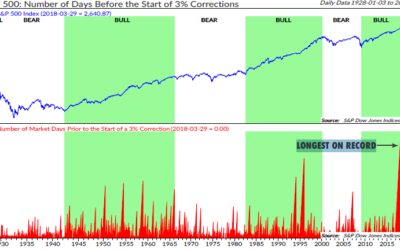

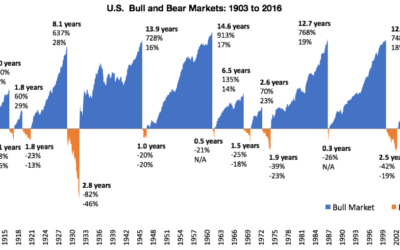

Successful investing is often determined by one's ability to stay the course. Since 2009, investors have had every excuse to bail out of stocks, but the market has continued to climb a wall of worry, becoming one of the longest bull markets in history. In fact, since...

Canal named Top 100 Emerging Wealth Manager

Canal Capital Management was recently named by RIA Channel to the list of Top 100 Emerging Wealth Managers for 2017. This year’s unique ranking showcases wealth management firms from $100 million to $500 million in assets under management as of October 31, 2017 that...

Outlook 2018 – Going Global!

“The world is a book and those who do not travel read only one page” – Saint Augustine At Canal Capital, we echo the sentiment of Saint Augustine, not only in life but also in investing. Those investors that take a myopic approach and only invest in the US, are...

December 2017 – Tax Cuts and Jobs Act

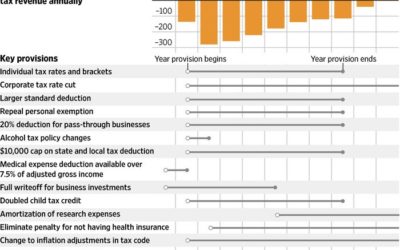

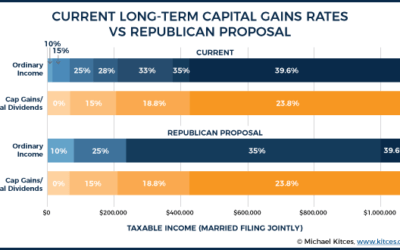

We are increasingly expectant that major tax legislation will become law as Republican leaders have indicated that after the latest round of quick negotiations, they have arrived at an agreement – the Tax Cuts and Jobs Act. We have been following the plans closely...

The “Tax Cuts and Jobs Act”

November 3, 2017: Yesterday House Republicans released details of the “Tax Cuts and Jobs Act” (link: Tax Bill). The plan calls for steep tax cuts in business tax rates, an eventual repeal of the estate tax, a reduction in the number of individual income tax...

Despite Uncertainty, Still Healthy!

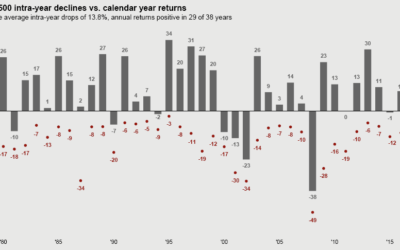

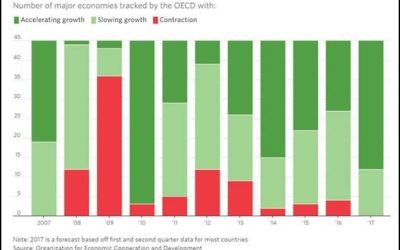

Despite the lingering uncertainty and questions related to global policy: Legislative, Monetary (the Fed) and Foreign, the market has continued to grind higher, further strengthening the argument that despite the negative and uneasy sentiment, markets and global...

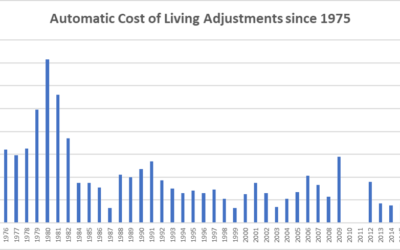

Social Security: 2% Rise in 2018 – the biggest increase since 2012

October 16, 2017: The US Government announced on Friday that Social Security checks are going up 2 percent in 2018, which is the first substantial raise in years. The raise is a cost of living adjustment (COLA) that’s meant to keep up with higher costs of everything...

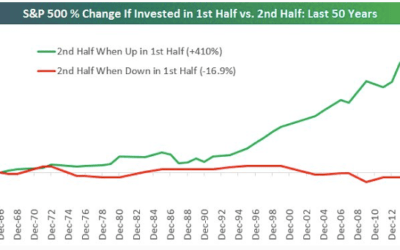

Stick With What’s Trendy

The first half of the year delivered superior returns for the US Stock Market as measured by the S&P 500 (+9.3%), but as we entered into the doldrums of Summer, that torrid pace slowed down considerably. June was a relatively flat month and the first few weeks of...

Frankie Says Relax

It's become a common theme in our newsletters where we like to remind investors (as well as ourselves sometimes) to take a step back from the headline news to examine where we really are in the current Bull Market cycle. While the news is constantly talking about a...