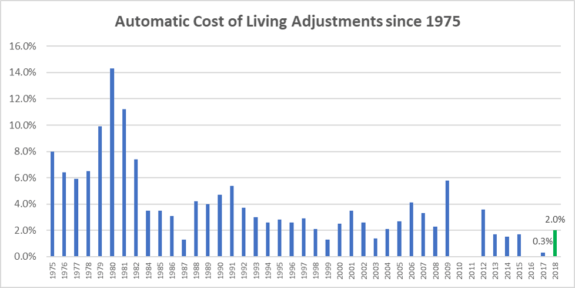

October 16, 2017: The US Government announced on Friday that Social Security checks are going up 2 percent in 2018, which is the first substantial raise in years. The raise is a cost of living adjustment (COLA) that’s meant to keep up with higher costs of everything from housing to medications. In 2017, the COLA was 0.3% and in 2016 it was 0%.

Ironically, a 2 percent increase for 2018 coincides with the unwinding of the Medicare Part B “Hold Harmless” rule that has prevented increases in premiums for the past two years (because of the low, or non-existent, COLA). So, many retirees will have their Social Security increase almost fully offset by higher Medicare costs.

In 2016 Congress closed the loopholes that effectively put an end to the “file and suspend” and “restricted application” strategies that married couples had effectively been using to increase their benefits. Even though those strategies are off limits, there is still benefit to reviewing your Social Security claiming strategy to maximize lifetime benefits. Keep in mind:

- Your Social Security retirement benefit is calculated by looking at your highest earning 35 years. You become eligible for retirement benefits after 40 quarters of earnings.

- For every year you delay claiming benefits past your full retirement age, the benefit increases roughly 8 percent per year.

- You can claim benefits before your full retirement age (age 66 for individuals born between 1943 and 1954), however if you earn more than $17,040 from employment in 2018 your benefit will be reduced.

- Married couples still have options for boosting their lifetime benefits and should have a coordinated plan for drawing Social Security.