Election 2020: Presidential Tax Plans

With the 2020 election around the corner, we thought it would be helpful to outline the presidential candidates' tax proposals. While it is difficult to determine which policy initiatives either candidate will eventually pursue, we will continue to monitor and keep...

Canal Capital Named to Inc. 5000

Canal Capital Management is pleased to announce that we have been selected to the Inc. 5000 list for 2020, our third year in a row. This is an annual ranking that consists of the fastest growing private companies in America....

Don’t Fight the Fed

After the S&P 500's worst first quarter on record, the stock market made history with an unprecedented recovery, taking many investors and prognosticators by surprise. Following the market lows reached on March 23rd, the S&P 500 was up 38% through the end of...

Covid 19 – Reflection & Response

We spent many hours at the end of 2019 looking at all the potential risks in the economy and markets and nowhere did we find a global pandemic caused by a bat in China. This quarter was the worst performing 1st quarter in history with the S&P 500 down 35% on March...

CARES Act | SBA EIDL & PPP Loans

As a follow up to our overview of The CARES Act sent last week, the third Federal stimulus bill in response to COVID-19, I wanted to provide you with a quick update on additional guidance recently issued on the two key SBA loan programs available to business owners:...

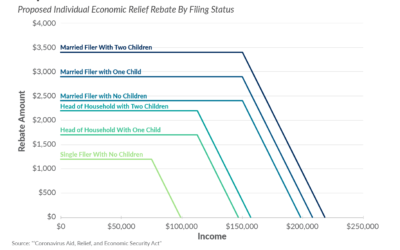

The CARES Act

Yesterday evening, the Senate passed an updated version of the Coronavirus Aid, Relief and Economic Security (CARES) Act (Stimulus Phase III). The bill is intended to be a third round of federal government support for individuals and businesses and is the...

Tax Extension

In response to the COVID-19 pandemic, Treasury Secretary Steven Mnuchin announced yesterday that individuals can defer April 15th tax payments up to $1 million, and Corporations can defer up to $10 million of tax payments, for 90 days. Please note that many...

Letter on COVID-19

As we briefly highlighted a few weeks ago, as the equity markets began to sell-off, we continue to monitor the economic turmoil and remain confident that global markets will recover from the economic uncertainty that we are facing with COVID-19 (Coronavirus). As we...

The SECURE ACT

Attached we have highlighted the key provisions The final weeks of 2019 brought the second major piece of tax legislation in the past 24 months, as the SECURE Act (The Setting Every Community Up for Retirement Enhancement Act), which was passed in the House over the...

Charitable Gifting from an IRA

Since 2006, IRA owners who are at least 70 1/2 can make a Qualified Charitable (QCD) of up to $100,000 directly from their IRA to a charity without having to include the distribution in taxable income. As a result of the late-2017 tax law passed by Congress, the Tax...