A Broadening Rally

Despite wars, hurricanes and a contentious election, the market continues its historic rise, consistently hovering around all-time highs. Click here to read Newsletter.

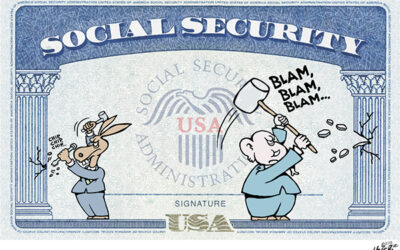

True State of Social Security-What You Need to Know

The Social Security system is facing significant challenges, with projections indicating that the Old-Age, Survivors, and Disability Insurance (OASDI) Trust Fund may be depleted by 2035. Click here to read more.

Canal Capital Named to Inc. 5000

Canal Capital Management is pleased to announce that we have been selected to the Inc. 5000 list for 2024, our sixth year in a row. This is an annual ranking that consists of the fastest growing private companies in America. Canal came in ranked at number 4,790, and...

Two Diverging Paths

The first half of the year is now in the books, and markets continued to perform well but were dominated by just a few names. For the first six months, the S&P 500 was up 14%, but 30% of that return was attributed to Nvidia which rose by 149% as the AI hype...

Election Guide

Click HERE to read more on our 2024 Election Insights.

Momentum

The first quarter turned out to be more of the same for markets, with stocks (S&P 500) up 10%, continuing the strong momentum of 2023. Any weakness only lasted a couple of days and investors bought the dip resulting in 22 all-time closing highs. Market leadership...

When you least expect it…

Almost no one thought 2023 was going to be a phenomenal year for stocks, but nearly all markets rebounded with many up over 20% on the year. Just like the consensus opinion of the “experts” missed the dramatic declines of 2022, most were overly negative for 2023 and...

It Continues to Start and End with ‘The FED’

Blue skies turned somewhat turbulent in the third quarter as markets (S&P 500) gave back some of their first half gains (nearly 20%) and are now up 12% as the quarter ended. Most of the volatility was once again the result of the Fed’s future direction of interest...

What Has Changed?

Markets continued their positive performance in the second quarter and the S&P 500 is now up 17% through the first half of the year. Many investors have been caught off guard as the outlook at the beginning of the year was doom and gloom. Cooling inflation, better...

TD and Schwab Conversion

On November 25, 2019, Charles Schwab announced that it would be acquiring TD Ameritrade and the deal officially closed on October 6, 2020. After nearly 3 years of combining operations and best practices, we are excited to announce that your accounts will be moving to...