by Noah Greenbaum | Jul 1, 2013 | Investments

We at Canal Capital Management are big believers in ETFs, otherwise known as Exchange Traded Funds, because of their salient characteristics: cheap, tax efficient, intra-day trading, index replicating, etc., But just like with any investment product, they are not all created equal. Due diligence is required when investing in any ETF. At our firm, we follow a disciplined process when vetting any investment, and ETFs are no exception. We apply the following test: Efficiency, Tradability & Fit. Efficiency looks at a fund’s costs, while Tradability assesses average daily trading volume, and Fit examines the securities the fund owns. Though it may sound corny, this mnemonic device describes a process by which we narrow down some 1,500 ETFs to a more manageable security universe of choices that will best fit our investment objectives.

(more…)

by Neil Gilliss, MBA, CFP | Mar 19, 2013 | Investments

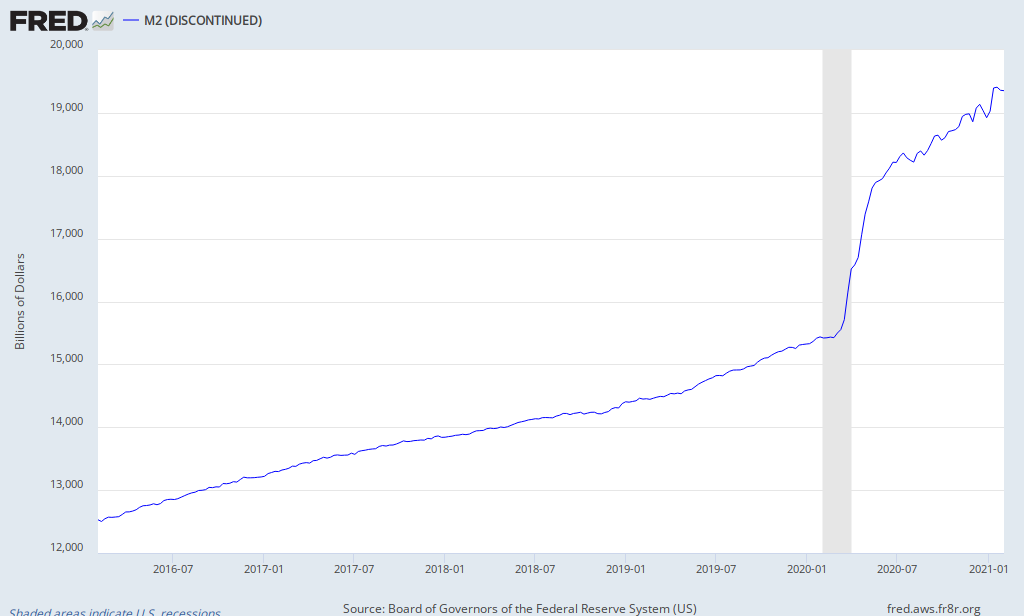

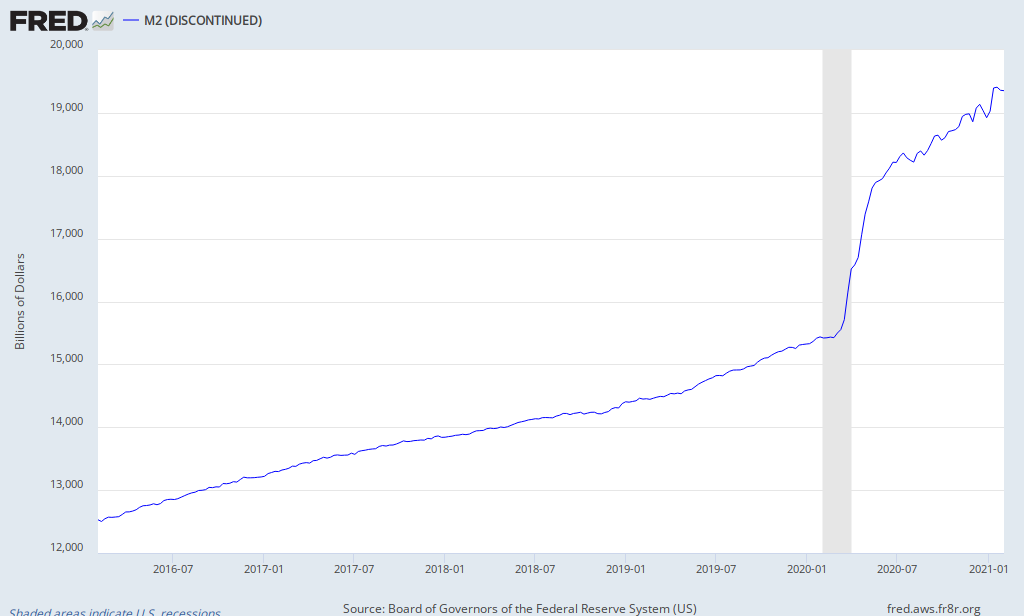

The general idea about inflation we are taught is that the greater the supply of money, the less a single dollar is worth, and the prices for the goods we buy should rise. This simple model usually holds true, yet policies by the Federal Reserve over the past five years have substantially increased the supply of money but have failed to stimulate above average inflation. Inflation lowers everyone’s purchasing power and erodes the real return on investments, so keeping an eye on when inflation might rise is important.

M2 Money Stock Since 2008

(more…)

by Noah Greenbaum | Mar 4, 2013 | Investments

People have long viewed bonds as a relatively risk free asset class, and who could blame them; since 1983, the Barclays Aggregate Bond Index has had an 8.1% average annual compound rate of return. During that period, it suffered only 3 negative years, with -2.9% being its worst. With interest rates inevitably rising, these numbers cannot continue. Bonds will switch from being risk free to risky. This “great rotation” from Bonds to Stocks will not be done without angst. Investors’ perception of risk will have change and managers who made their careers during the bond bull market will evolve while a new era of asset allocation is ushered in.

(more…)

by Neil Gilliss, MBA, CFP | Feb 19, 2013 | Investments

When we began using ETFs several years ago in our portfolios, we had no idea the size and power of the wave we were catching. At the time we were using Modern Portfolio Theory and calculating optimal asset allocation using historical index return data. We then picked managers we hoped (yes, hoped) would outperform those indices. There is no academic research or practical process for identifying managers who will beat their benchmarks. Research by Standard And Poors has shown that about 1 in 5 mutual fund managers beat their benchmarks in any given year, dropping as time goes on. So when we were told we could achieve benchmark returns year after year for a lower cost, the decision to abandon our hoping for a more prudent approach was an obvious one.

(more…)