2019 Investment Outlook

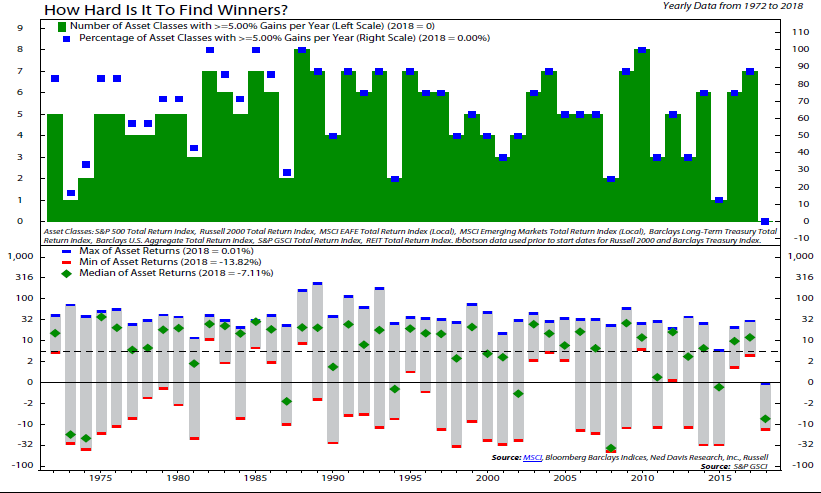

What a difference a year makes! The largest drop in 2017 was less than 3%, while 2018 experienced the largest drop since 2009 at nearly 20%. In 2017, December saw near record highs while December of 2018 was the worst on record (except 1931, The Great Depression); Christmas Eve was the worst in history. Stocks were not the only problem investment: nearly every major asset class was negative for the year with the exception of the aggregate bond index which was up 0.01%. The chart below shows that among the eight largest asset classes, none gained more than 5% for the first time since 1972 (see chart below). 2018 was a major anomaly and will go down in history as a tough year for investors.

Click here to read our full 2019 Market Outlook

Storm Clouds

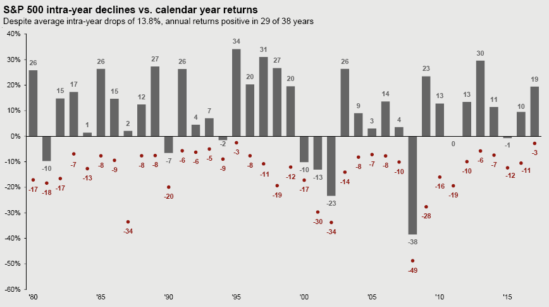

Despite what some people may say, no one really knows the exact reason as to why the market has pulled back so ferociously, but what we do know is that in any given year, the market normally has 3 drops of over 5%. This is the 2nd drop this year after zero in 2017. In other words the market generally goes up over time, but can take a step back or two at any moment. That said, markets tend to move in cycles and we must be cognizant of where we are because, as cycles get longer, pullbacks tend to become more frequent and more severe.

Please click here to read our 3rd Quarter 2018 Market Commentary

How to Handle a More Volatile Market

“Everyone has a plan until they get punched in the mouth.” -Mike Tyson

While we are bullish in the short term, we remain cognizant of where we are in the cycle and are preparing ourselves for what a down market may bring. Having a plan in place beforehand helps control emotions and ultimately leads to better investment decisions. In this latest newsletter, we’ve taken a look back at this past quarter, some of the things that are causing the choppiness in the market: tariff talks and rising interest rates, and how we are preparing for a more volatile market environment.

Where Do We Go From Here?

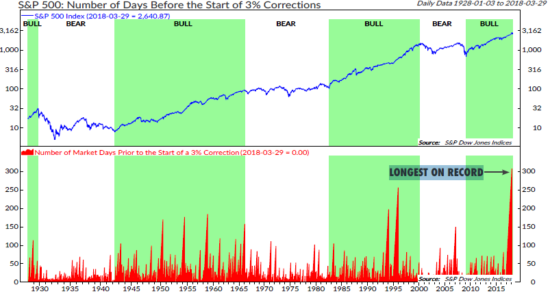

Successful investing is often determined by one’s ability to stay the course. Since 2009, investors have had every excuse to bail out of stocks, but the market has continued to climb a wall of worry, becoming one of the longest bull markets in history. In fact, since March of ’09, the S&P 500 is up 290%. By historic measures, this market has lasted 108 months vs 54 months for the average bull market. The question becomes: Where are we now? In our humble opinion, we are probably pretty deep into the 4th quarter and might go into overtime.

Click Here to Continue Reading our 1st Qtr 2018 Market Commentary

Outlook 2018 – Going Global!

“The world is a book and those who do not travel read only one page” – Saint Augustine

At Canal Capital, we echo the sentiment of Saint Augustine, not only in life but also in investing. Those investors that take a myopic approach and only invest in the US, are reading but only one page in the book of investment opportunities. Yes, the US Market has led the charge for the last 8 years and investors have been hurt by diversifying, but a shift is beginning to happen and it is our belief that those investors willing to read past the first page and go global, will be rewarded moving forward.