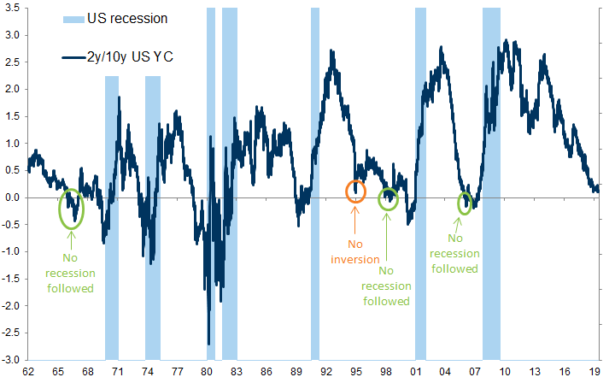

On August 14th, the 10 year Treasury Yield went slightly below the yield for the 2 year Treasury, the first time this has happened since 2007. Economist pay close attention to the 10 year vs. 2 year Treasury yields, as its historically been a strong predictor that a downturn is on the way. The yield curve has inverted before every US recession since 1955, although it sometimes happens months or years before the recession starts. The average time between the last 5 yield curve inversions and a recession was 17 months. This lead time is the key and its still very uncertain how long a lead time we may have in the current economy before there is an actual recession. That said, an inverted yield curve, like most other indicators, is not perfect and doesn’t mean a recession is imminent.