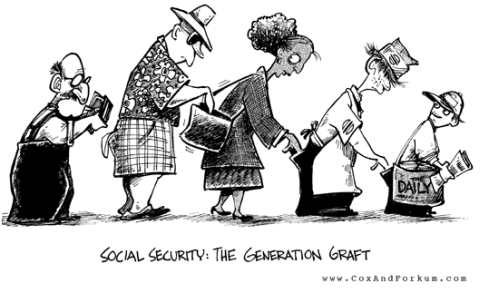

Recently Congress announced that it is making changes to the Social Security filing strategies that many couples have used for years to add thousands of dollars to their retirement incomes. Before you read any further, please note that if you are already receiving Social Security benefits based on your own record, or by using one of the strategies that will soon go away, your benefits will not change or be interrupted by the legislation.

The legislation in question, the Bipartisan Budget Bill 2015, was passed by the Senate last week and will likely become law once signed by the President. The two strategies under fire – known as file-and-suspend and a restricted application for spousal benefits – have made it possible for couples to delay claiming Social Security benefits based on his or her own earning record, each taking advantage of their eventual benefit growing by 8% per year for each year deferred, while one spouse can claim ½ of the other spouse’s benefit until switching to their own (often age 70). To do this, typically the higher earner files for benefits and suspends them, while the other files a restricted application for spousal benefits.

Here’s what you should know:

There’s a six-month window before the new rules begin. In six months Social Security will no longer allow relatives to submit a claim for spousal benefits based on the earnings record of someone who has suspended his or her own benefits. If you are 65 ½ or older now, there may be an advantage to “file-and-suspend” within the next six months to give a spouse the option to file for spousal benefits.

Individuals between 62 and 65 get a break. If you are 62 or older in 2015, you will still be able to file a restricted application for spousal benefits starting at age 66 if your spouse is already claiming a benefit. For couples with at least one spouse between 62 and 66, and not yet claiming benefits, we recommend that you review your benefit claiming strategy.

Widows and widowers won’t be affected. Individuals eligible for both earned and survivor benefits will continue to have a couple of claiming strategies open to them.

We are working to evaluate the impact that proposed changes will have on you, and your Social Security claiming strategy. While this recent ruling leaves what was already a complex system still very (or now even more) complex, there are still opportunities for individuals and spouses between the ages of 62 to 70. With the looming deadlines outlined in the bill, time is of the essence.

Each situation is unique. If you believe you may be impacted by the legislation, please call or email us to discuss your benefits and the optimal filing strategy.