The general idea about inflation we are taught is that the greater the supply of money, the less a single dollar is worth, and the prices for the goods we buy should rise. This simple model usually holds true, yet policies by the Federal Reserve over the past five years have substantially increased the supply of money but have failed to stimulate above average inflation. Inflation lowers everyone’s purchasing power and erodes the real return on investments, so keeping an eye on when inflation might rise is important.

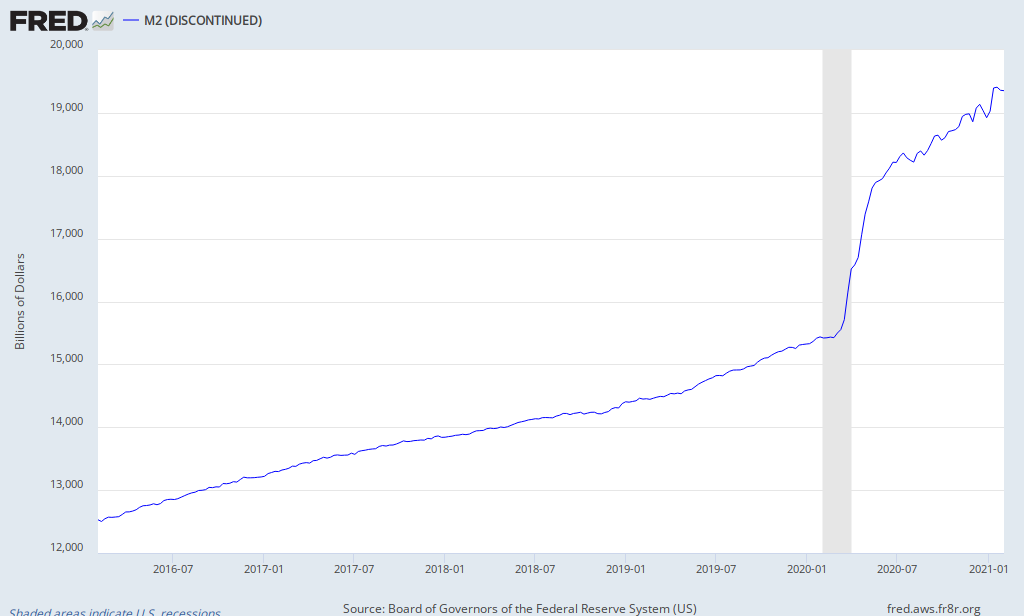

M2 Money stock, shown above, is a measure of all of the money held in various forms of bank deposits. As you can see, since the start of the financial crisis the money supply has increased by roughly 40%, yet the growth rate of the Consumer Price Index (shown below) has remained relatively flat.

Coming out of a recession there are a host of reasons why inflation might be resistant to an increase in the supply of money. Economic participants remain timid even after a recession has ended, banks are hesitant to lend and consumers are equally hesitant to borrow. Even companies have been slow to reinvest in their own businesses as evident by the record levels of cash being held on the balance sheets of American companies. Simply put, this new money isn’t being circulated in the economy; it’s just sitting in bank reserves waiting for demand to pick up.

Enter Velocity

The Federal Reserve measures the turnover in the money supply through a statistic called “Velocity.” Velocity is a measure of the number of times a dollar is used to purchase final goods and services included in GDP. It can be thought as a rough measure of economic activity, and since the year 2000 it has been in a precipitous decline.

While gold bugs and doomsayers would have you believe that the US is facing a period of hyper-inflation, we believe until the velocity of money shows a marked improvement; inflation is likely to be moderate.

A far bigger threat to the economy is the tactfulness with which the Federal Reserve begins to reverse course on the policies of the past five years. Should its hand be unexpectedly forced by inflation it is uncertain what tools the Fed has retained to combat simultaneously rising prices and a struggling economy. Moderate levels of inflation are good for a variety of reasons but if the rate of inflation picks up too quickly, the Fed could get caught flat footed.

From a portfolio perspective, real assets such as real estate and commodities are typically good hedges against inflation. Surprisingly, equities also hedge well against inflation as the intrinsic value of companies remain stable relative to the value of a dollar. Bonds and other fixed payment securities typically do the worst.

Inflation expectations are an important consideration of portfolio construction and management, but they are long-term considerations as inflation expectations vary far more wildly than actual inflation. A well-constructed portfolio should withstand a variety of economic regimes and be easily modified as long-term trends develop.