by Margaret Smith, CPA | Dec 27, 2019 | Financial Planning

Attached we have highlighted the key provisions

The final weeks of 2019 brought the second major

piece of tax legislation in the past 24 months, as the SECURE Act (The Setting

Every Community Up for Retirement

Enhancement Act), which was passed in the House over the summer,

finally made its way through the Senate and was signed into law by the

President. The legislation may have significant repercussions for individuals

engaged in retirement and estate planning.

by Margaret Smith, CPA | Oct 25, 2019 | Financial Planning

Since 2006, IRA owners who are at least 70 1/2 can make a Qualified Charitable (QCD) of up to $100,000 directly from their IRA to a charity without having to include the distribution in taxable income. As a result of the late-2017 tax law passed by Congress, the Tax Cuts and Jobs Act (TCJA), the OCD strategy has become even more valuable to taxpayers.

Please click here to read more about this strategy

by Margaret Smith, CPA | Feb 1, 2019 | Tax & Financial Planning

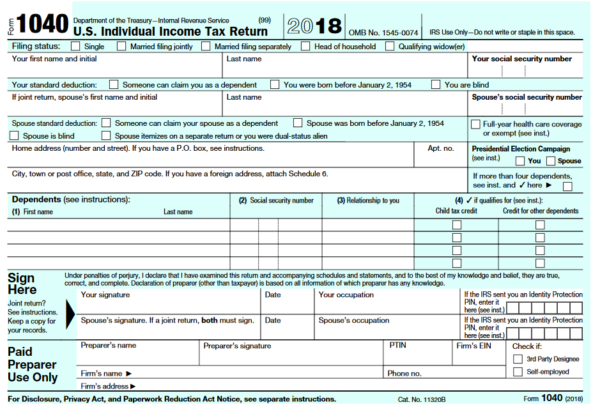

Just as the government shutdown ended, the IRS kicked-off its’ 2019 tax filing season this week on Monday, January 28th. With the window now open to file returns, we would like to draw your attention to the new postcard-sized 1040…and why it may not be as simple as it seems.

Click Here to Read our February 2019 Tax & Planning News

by Margaret Smith, CPA | Nov 19, 2018 | Tax & Financial Planning

by Margaret Smith, CPA | Jun 18, 2018 | Tax & Financial Planning

Tax-Deferral Opportunity on the Sale of Low-Basis Assets:

Are you considering selling stock, real estate, or a business that has substantially appreciated in value? Are you concerned with the capital gains tax that will accompany those sales?

The December 2017 Tax Cuts and Jobs Act (TCJA) provides a new tax incentive and potential solution for investors to defer, if not eliminate, capital gains tax on the sales of assets in exchange for investments back into Qualified Opportunity Zones (“QOZs”) across the Commonwealth. Click here for more details